- #ZEBRA TECHNOLOGIES STOCK SOFTWARE#

- #ZEBRA TECHNOLOGIES STOCK PROFESSIONAL#

- #ZEBRA TECHNOLOGIES STOCK FREE#

#ZEBRA TECHNOLOGIES STOCK SOFTWARE#

The solutions get integrated vertically into the workflows of the customer, offering a very sticky business which then gets expanded with software and analytics services. Zebra operates in a lot of different industries, ranging from retail and warehousing to healthcare and hospitality. Zebra Technologies margins (Koyfin) Economic Moat Zebra now employs more software engineers than hardware engineers. In recent years Zebra has shifted focus from hardware offerings to software offerings, which should help margins increase over the next decade.

They aren't the most stable, especially due to the company's M&A track record with often large deals that need to get integrated into the company. Zebra Technologies' margins have been largely consistent over the last 15 years.

#ZEBRA TECHNOLOGIES STOCK FREE#

Zebra Technologies Free Cash Flow (koyfin) Margins It isn't the most smooth upwards trend, largely due to the M&A part of the business, but the long-term direction is good and I expect them to grow FCF/share in the low teens given the markets they are in and that they are well run with sticky products. Zebra generates considerable free cash flows, which are rising over time.

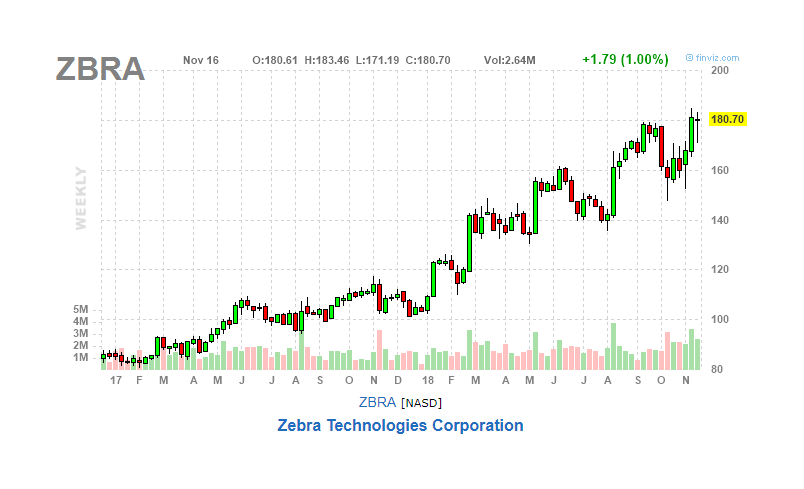

Zebra Technologies market share ((UBS)) Free Cash Flow Zebra being the Market leader in a growing market means a check on the list. Being a conglomerate though, Honeywell lacks focus and can in no way be considered a pure-play into these segments. Honeywell ( HON), an American conglomerate, is the main competitor in all segments. Besides Data capture, where the competition is fierce, Zebra is by far the biggest player in its segments. They are also the market leader in their different segments. According to grandviewresearch, the machine vision market is expected to grow to $26 billion by 2030, with a CAGR of 7.7% over the next 8 years.Īs we can see, Zebra is operating in markets growing at an attractive pace. The best fits for their markets are Warehouse automation and Machine vision.Īccording to thelogisticsiq, the warehouse automation market is expected to grow to $41 billion by 2027, a compound annual growth rate (CAGR) of 15% in the next 5 years. Zebra is operating in a variety of different markets with a wide variety of products and services. How is the capital allocation strategy?.Is the company led by an owner-operator?.Do they have a wide economic moat and is it widening?.Are they a market leader in a growing market?.My checklist will run through the following criteria: I will run Zebra Technologies through my quality checklist to find out if it is a high-quality company worth investing in. Warehouses will play an increasingly important part of our supply chain and Zebra is here to profit from it. The company is the market leader in a growing industry with a good moat and capital allocation strategy. Zebra Technologies ( NASDAQ: ZBRA) is a buy after a significant drawdown from its ATH. The company was founded in 1969 and is headquartered in Lincolnshire, Illinois.Sundry Photography/iStock Editorial via Getty Images Thesis The company serves retail and e-commerce, manufacturing, transportation and logistics, healthcare, public sector, and other industries through direct sales force, and network of channel partners.

It also provides cloud-based software subscriptions and robotics automation solutions. In addition, the company offers barcode scanners, RFID readers, industrial machine vision cameras, and fixed industrial scanners, workforce management solutions, workflow execution and task management solutions, and prescriptive analytics solutions, as well as communications and collaboration solutions.

#ZEBRA TECHNOLOGIES STOCK PROFESSIONAL#

It also provides various maintenance, technical support, repair, and managed and professional services real-time location systems and services and tags, sensors, exciters, middleware software, and application software as well as physical inventory management solutions, and rugged tablets and enterprise-grade mobile computing products and accessories. The company designs, manufactures, and sells printers, which produce labels, wristbands, tickets, receipts, and plastic cards dye-sublimination thermal card printers, which produce images which are used for personal identification, access control, and financial transactions RFID printers that encode data into passive RFID transponders accessories and options for our printers, including vehicle mounts and battery chargers stock and customized thermal labels, receipts, ribbons, plastic cards, and RFID tags for printers and temperature-monitoring labels primarily used in vaccine distribution. It operates in two segments, Asset Intelligence & Tracking and Enterprise Visibility & Mobility. Zebra Technologies Corporation, together with its subsidiaries, provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide.

0 kommentar(er)

0 kommentar(er)